· Ruchin Tejawat · Knowledge · 2 min read

Impact of recent Adani group news on NIFTY 50

The Adani Group, founded by Gautam Adani in 1988, is one of India's largest multinational conglomerates, with interests spanning ports, logistics, power generation, renewable energy, infrastructure, and more.

Adani Group operates in sectors critical to India’s growth :-

a) Ports and Logistics b) Energy c) Infrastructure d) Agri Business and defense

Adani Group share in NIFTY 50 :-

Adani Ports and SEZ Ltd 0.93% Adani Enterprises Ltd 0.54% Total share of Adani Group 1.47%

Recent news on Adani Group :-

Gautam Adani, along with seven others, has been charged by U.S. authorities in a $265 million bribery and fraud scheme. The allegations claim that Adani and his nephew, Sagar Adani, paid bribes to Indian officials to secure lucrative solar energy contracts, expected to yield $2 billion in profits. The charges include violations of U.S. securities laws and the Foreign Corrupt Practices Act. The Adani Group allegedly misled investors, raising over $3 billion through fraudulent means.

Impact of above news on NIFTY 50 :-

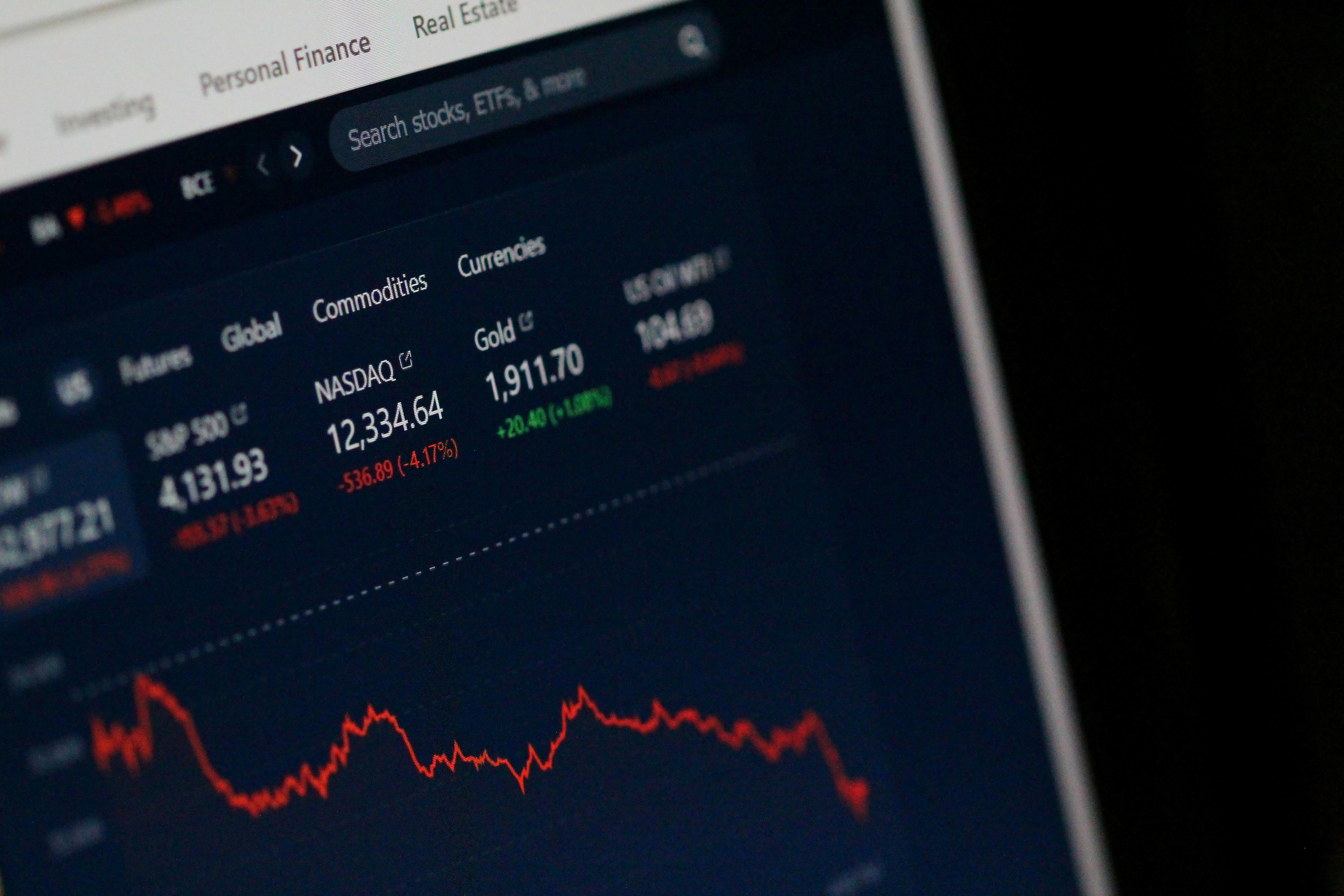

The bribery allegations against Gautam Adani have significantly impacted the Nifty 50 index. Stocks of Adani Group companies, such as Adani Enterprises and Adani Ports, which are part of the index, have witnessed sharp declines—up to 20% in some cases. This sell-off has added downward pressure to the overall Nifty 50, which has seen broader market weakness due to the controversy. Additionally, concerns about corporate governance and regulatory risks surrounding major companies can negatively influence investor sentiment and market stability