· Ruchin Tejawat · Knowledge · 2 min read

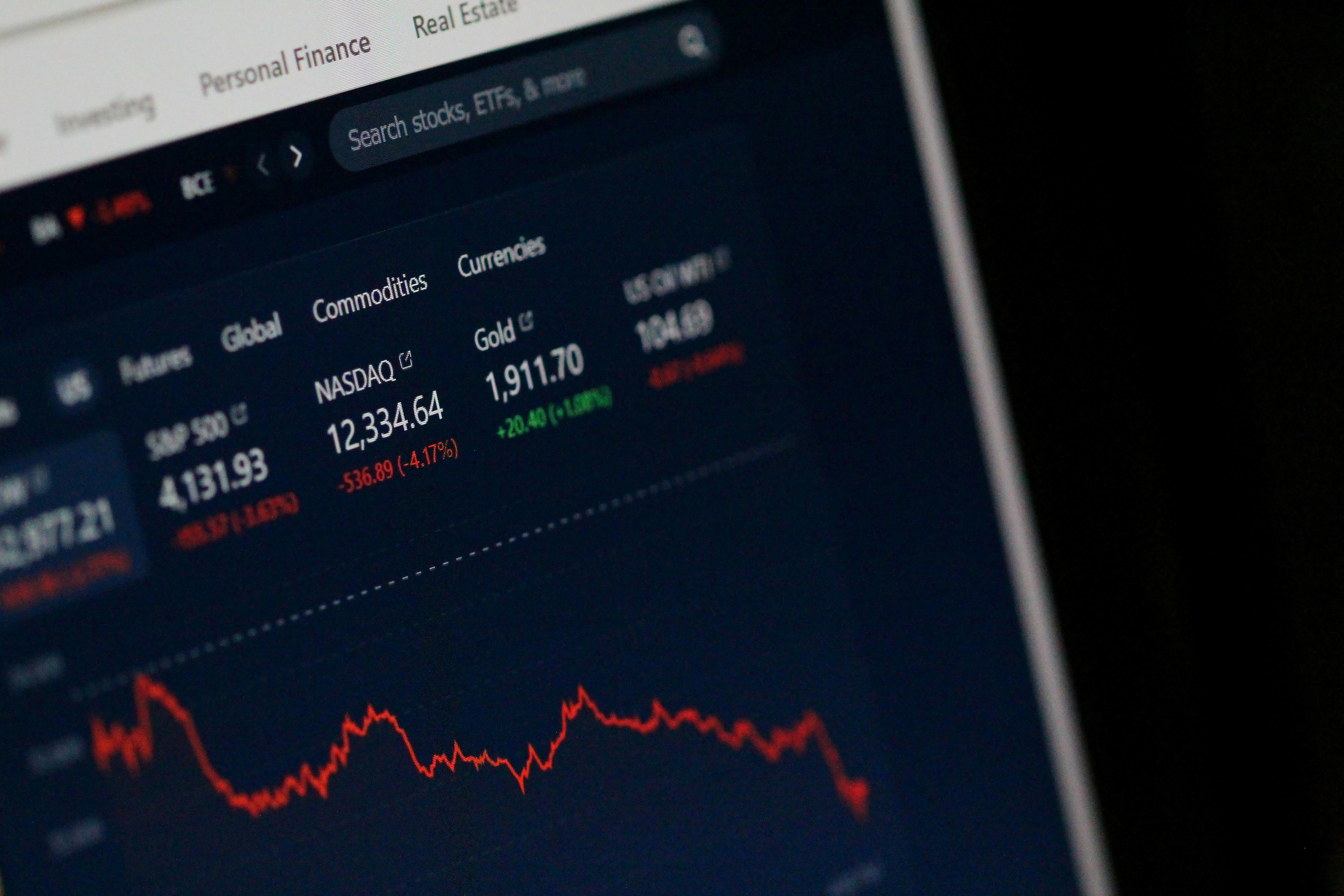

How to control drawdowns during falling markets ?

Controlling drawdowns during falling markets is crucial to protecting your capital and ensuring long-term success in trading or investing.

Here are several strategies to control and manage drawdowns during falling markets :-

1) Diversification

- Diversification reduces risk by spreading investments across different asset classes, sectors, or geographies.

2) Use Stop-Loss Orders

- Stop-losses help you exit positions when the market is moving against you, preventing further drawdowns.

3) Hedging Strategies

- Hedging involves taking positions that offset potential losses in your main investments. Common hedging strategies include :-

4) Options

- Buy put options to protect your portfolio. A put option gives you the right to sell an asset at a predetermined price, limiting your downside if the market falls. Use protective puts on individual stocks or indexes to guard against significant declines.

5) Inverse ETFs

- These are designed to move in the opposite direction of an index.

6) Gold or Safe-Haven Assets

In times of uncertainty, investors often flock to gold, US Treasuries, and other safe-haven assets, which tend to retain or gain value when equities fall.

7) Position Sizing and Risk Management

- Proper position sizing can help control drawdowns by limiting the amount of capital you risk in any single trade or investment.

8) Stay in Cash During Market Volatility

- Sometimes, the safest strategy in a falling market is to move a portion of your portfolio to cash or cash-equivalent assets. This removes the risk of losing money in the short term, providing flexibility and liquidity to re-enter the market when conditions stabilize.

9) Emotional Discipline

- Avoid panic selling during market downturns, and don’t make impulsive decisions based on fear.